¿Qué encontrarás en este artículo?

ToggleW. J. Reddin

Reviewing your subordinate managers’ progress three times during the year is absolutely mandatory for every manager.

Our system rewards managers mainly on the basis of ratings of their overall performance against all their EAs particularly their performance against their objectives.

The organization considered here is Westpac Banking Corporation. It is the largest bank in Australia, and one of the largest in the world, with over 35,000 employees. The organization accepted the ideas of outputs fully and used them for a basis for many systems. This chapter describes what the bank actually did. It took a great deal of hard work and some time to accomplish all this.

As this book goes to press, over 1700 managers from the CEO down have completed the 3-D Managerial Effectiveness Seminar as described in Chapter 10. There have been about 50 team meetings starting with the top team and moving downward through the organization and several large group meetings addressing such issues as reorganization, changes in personnel policy and how to make a merger effective. As seen by the bank the environment was changing rapidly and was about to change even more rapidly. A government commission was expected to propose that foreign banks could enter the market, as it did, and this would produce an even greater need for a flexible response. That, together with a new CEO with deeply held views about output orientation, led to the start of this organization development programme which has been described as the largest and most successful in the world.

This chapter is based, in the main, on an internal booklet distributed by the bank with the title Managing for Results – The Westpac Management System. It is also based on a talk given by Bob White, CEO of Westpac Banking Corporation, to a meeting of the International Monetary Conference held in Boston. A contribution was also made by Geoff Thompson, New Zealand and General Manager and Ross O’Brien, Chief Manager, Personnel and Support Services.

At the outset of the programme the bank’s annual profit was $ 100 million. Some senior managers were somewhat embarrassed with how high it was. After some years the profit increased to approximately $ 800 million. Obviously, it would be impossible to attribute a percentage of variance in the change of profit to any particular thing. Without question, the critical element was the new CEO. However, there is a widespread view in the bank that the output orientation programme did help a great deal. Looking at the increase in annual profit it is clear that the cost-effectiveness of the programme bordered on the enormous. All material marked with bullets is taken directly from an internal document: “Managing for Results – The Westpac Management System” used by all managers. Other material is direct quotes from Bank Offices.

The emphasis on job effectiveness descriptions

It is evident that the bank gave central importance to job effectiveness descriptions.

- Every managerial position in Westpac is described in terms of its output requirements. These descriptions are called Job Effectiveness Descriptions or JEDs.

- A Job Effectiveness Description, or JED, is a description of a managerial position using output terms. It comprises a manager’s effectiveness areas and their accompanying measurement areas and authority areas.

- Your JED provides anyone who has little or no knowledge of your job with:

Effectiveness Areas: a list of the results you are required to achieve through your daily work (your outputs).

Measurement Areas: a list of the ways in which your outputs area measured in your progress reviews and when you are being appraised.

Authority Levels: the levels of authority allocated to your position and thus what actions you can take and what decisions you can make without referring to your superior. - Your JED is very important because it helps you think of your job, and those of your subordinates, in terms of outputs. It is an essential part of Westpac Management System because it is the basis upon which your objectives are written. Your planning starts with your JED.

- Your subordinate managers’ JEDs should be reviewed, updated and confirmed annually, at any restructure and on any change of incumbent in a job. This should usually be done at a team effectiveness review or normal team meeting.

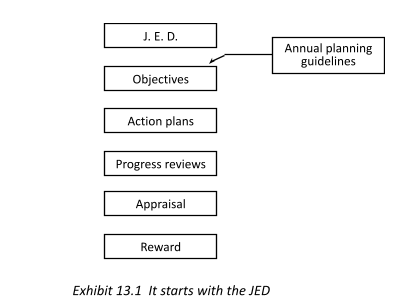

Use of a JED helps us think of our jobs and those of our subordinates in terms of outputs, rather than the things we do, which are inputs. - Our JEDs are the first link in a chain that leads to the rewards we receive. The full process looks like this:

If you want to get rewarded, start with a JED.

Two particular aims of these reviews of JEDs are:

- To ensure that the EAs of your subordinate managers are complementary and do not overlap or underlap.

- To make sure that your EAs incorporate those of your subordinate managers and that your EAs are incorporated in those of your superior. This helps ensure that your EAs complement those of the other managers in Westpac.

Effectiveness areas (EAs)

- Your EAs must not overlap or underlap with those of the other managers at your level. Overlap is when two positions are accountable for the same output and underlap is when no position has assigned the accountability for an output.

- Your EAs must incorporate those of your subordinate managers and your EAs will be incorporated in those of your superior. This helps ensure that your EAs complement those of the other managers in Westpac.

- Avoiding overlap and underlap and ensuring that EAs are complementary is an essential part of the regular reviews of your team’s JEDs.

- Although your EAs must incorporate those of your subordinate managers, you may also write additional, personal EAs (and objectives) if you wish.

- EAs should be written in one to four words. Avoid the use of words such as ‘increase’, ‘maximize’ and ‘satisfy’ and any quantities or timings. Otherwise the EAs will become measurement areas or objectives.

Measurement areas (MAs)

- A measurement area is a statement of how an output described by an EA will be measured.

- At least one MA should be written for each EA.

- It is important that your MAs be agreed and clearly understood by you and your superior. These agreed MAs will be the only measures used in your objectives and will be used when your superior reviews your progress towards, and appraises your performance against your objectives.

- Choosing the best possible MAs is important if we are to use the Westpac Management System effectively.

System linkages to the JED and outputs

As indicated in Chapter 11, many in-company systems can be linked to the JED and outputs. The list provided there included:

- Basic corporate philosophy

- Management information system

- Objectives

- Appraisal

- Budgets

- Job specification

- Selection

- Job evaluation

- Organization design

- Teamwork

- Rewards

This is what the Bank did about each.

Basic corporate philosophy

The basic corporate philosophy is best summed up in these statements.

- The bank’s output statement is: ‘The competitive servicing of customers’ needs.’

- The output statement highlights our customers’ needs as the most important factor in our corporate life. It recognizes the fact that we could not exist without our customers.

- Our output statement means that we must change from a bank driven by our own concerns to one driven by our customers’ needs. For example, we must learn to be more influenced by our customers’ requirements than by the requirements of our trading bank computer system or the fact that we have a branch network.

- Our output statement gives direction to the many changes occurring in the bank. It guides our major product and market strategies and should also help in many day-to-day management decisions.

- The importance of our output statement is reflected in the fact that every submission to the bank executive committee must include a Customer Impact Statement.

- The bank has four medium-term output statement goals:

- Being better at understanding the financial needs of our customers so as to produce the right products for each customer segment;

- Being better at providing a total financial management service to our customers;

- Being better in the customer service orientation of all our people, particularly their friendliness and helpfulness;

- Being an organization which encourages excellent performance by its managers.

- The achievement of these goals is critical to the future success of the bank.

- The achievement of these goals requires the contribution of all bank managers. Managers are expected to explain the goals to their team members and to set them an example by their efforts towards achievement of the goals.

Management information system

With the bank’s emphasis on outputs and the JED management information system obviously had to be organized around outputs. For a while, two systems were, in fact, running; one based on the prior method of inputs and the other on the emerging method of outputs.

Objectives

Every manager in the bank, there were about 3000 of them, had to have very carefully set and reviewed objectives. The objectives were, basically, on an annual basis and reviewed quarterly although this varied with the nature of the work being done.

Characteristics of good objectives

- The four characteristics of good objectives are:

- Measurable: objectives must include a quantity and be easily measurable. If a result can’t be measured, then there’s no point in trying to achieve it because no one will know if you do. The measurement areas used to make your objectives measurable are recorded in your JED.

- Specific: objectives must describe the results you plan to achieve as precisely as possible.

Time-bounded: objectives must specify the dates by which results will be achieved or the periods during which results will be achieved. - Challenging: objectives should be pitched at a level that will provide a sense of accomplishment and develop your managerial skills. However, they should not be so difficult that they are beyond your abilities and should not be outside your authority levels.

- Your objectives must be directly linked with your JED. They must correspond to your effectiveness areas, use your measurement areas and be within your authority levels.

- Your objectives should reflect your most important EAs. Line managers should write objectives that are market-centred and focus on the success of their business. Administrative managers should write objectives that are user-centred and affect the quality of the service they provide.

- As stated, objectives must be consistent with the annual planning guidelines. Any objectives that are not consistent will have to be altered.

- After you draft your objectives, they are negotiated with your superior and between two and eight are agreed and recorded on your appraisal form.

- The role of the superior at objective-setting discussions is very important. It is the superior’s responsibility to ensure that the objectives are good ones and reflect the most important EAs. This is done by comparing them with the objectives of the other managers in the team and, if necessary, negotiating with the manager to change them. Therefore, negotiating skills are very important.

- Most managers find it necessary to require their subordinate managers to accept additional objectives during the year; for example, because of new policy decisions by general management. These new objectives are recorded on the subordinates’ appraisal forms and because of the additional workload involved, the priorities placed on them and the time required to achieve them are taken into account in appraisals.

- Having objectives that have been agreed with your superior, and agreeing objectives for your subordinate managers, is absolutely mandatory for every manager.

Obtaining the right degree of challenge

- Many managers find it difficult to obtain the right degree of challenge in their objectives.

- You can also say in retrospect that if all your subordinate managers achieve all their objectives, then they may not have been challenging enough. And that if none of your subordinate managers achieved any of their objectives, then they were probably too challenging.

- The biggest problem in negotiating and agreeing on this degree of challenge is to obtain consistency across the different areas of Westpac. Consistency is critical if our performance appraisal and reward system is to work properly. As yet we have no effective means of measuring this degree of challenge and so we must rely on the experience of, and communication and peer group pressure between senior managers.

- Some lower level managers have also reported that it is difficult to obtain a consistent degree of challenge in the objectives of their subordinates, even when their subordinates’ jobs are similar. As stated in the text, managers must negotiate this degree of challenge with their subordinates. It is suggested that the negotiation takes place in a team meeting where team members can bid for ‘shares’ of the team’s objectives to be achieved. This provides a comparison of the degree of challenge provided to each subordinate and places peer group pressure on them to accept appropriately challenging objectives.

Subjects of objectives

- The subject of your objectives (that is, the things you plan for) are described by the EAs in your JED. Each objective must correspond to an EA.

- Because your EAs must complement those of the other managers around you and must not overlap or underlap, this will ensure that your objectives are complementary and don’t overlap or underlap.

- As your EAs must be within your authority levels and the limits of your accountability, so too must your objectives.

- Each of your EAs should represent an important or significant part of your job. Your objectives correspond to the most important EAs and should affect the success of your business if you are a line manager or the quality of the service you provide if you are an administrative manager.

- Your objective must be consistent with the annual planning guidelines.

Reducing forecasting errors

- Forecasting errors have been reported as a problem by some line managers whose measurement areas involve forecasts of business conditions. Some administrative managers also find forecasting difficult because the service they provide takes the form of projects that require considerable time to complete; and an increase in demand for these services can considerably deplete their staff resources.

- It must be understood firstly that objective-setting always involves forecasting.

- Secondly, forecasts 12 months ahead are always inaccurate to some degree. In extreme cases, managers can find after a few months either that they have already achieved their objectives or that achievement will be impossible.

- One consideration when you find forecasting errors a problem is to make sure you are planning for the right things. Your objectives must correspond to your most important EAs and be within your authority levels. This ensures that you have adequate authority to compensate for changes in the environment and achieve the results you have planned for.

Examples of objectives for regional managers

- Complete regional market analysis (in Network Design regions, with district marketing teams) by end of October.

- Within the personal customer market segments identified, increase product sales as follows:

Term Deposits under $ 50,000 20 per cent

Advantage Saver 60 per cent

NBI Deposits 10 per cent

Personal Loans 35 per cent - Increase (by the end of September) the number of customers in seven commercial market segments as follows.

Doctors 50 per cent

Solicitors 70 per cent

Accountants 45 per cent

Real estate agents 50 per cent

Dentists 35 per cent

Newsagents 60 per cent

Grocers 55 per cent - Increase annual average bill acceptance line outstandings by 75 per cent on previous year.

- Increase total charges and commissions collected during current year by 15 per cent on previous year.

- Increase the annual average interest rate on advances, after allowing for changes in market rates, by 0.2 percentage points on previous year.

- Reduce personal loan write-offs to less than 2 per cent of outstandings by end of September.

- Amalgamate two branches without losing business by end of September.

Annual plans

- Annual plans commit us to achieving specific results using the resources we have allocated. They focus on the group’s sales, income, expenditure and profit. Branches, districts, regions and divisions all make annual plans and these are combined to make a group plan.

- The annual planning process starts with guidelines that are prepared by general management on the basis of the first year of the medium term plan. The annual planning guidelines consist of ‘where we want to go’ statements.

- The second step in the annual planning process is for managers to write their own objectives and negotiate and agree them with their superior. It is essential that managers’ objectives at all levels be consistent with the annual planning guidelines.

- Finally, these objectives are combined to make a group plan that consists of ‘where we want to go’ statements and supporting budget commitments.

- Thus, our annual planning process is interactive and emphasises negotiation. It is partly ‘top-down’ and partly ‘bottom-up’.

- Because all the objectives agreed in the annual planning process are interrelated, the timing of their preparation is important. Any deadlines given must be adhered to.

- The most important parts of our annual planning process are the objectives of our line divisions. A major feature of the process is that our group plan is a combination of individual managers’ plans, so that the things our group does are directly related to what individuals do.

Appraisal

While appraisal was always made formally of all objectives set, the emphasis was on progress reviews and performance counselling. It is better to avoid things that one does not want to happen rather than just comment on them at the end.

Objective of appraisal

- The objective of our appraisal and reward system is to improve the performance of our people, so that Westpac’s performance is improved.

- Progress reviews and appraisals provide us with feedback on our performance, which helps us to improve it. Everybody needs continual day-by-day feedback to maintain their enthusiasm and feel part of a team. Progress reviews and appraisals add to this by providing us with comprehensive, structured feedback.

Managerial appraisal form

- Our managerial appraisal form recognized and rates our performance, highlights our development needs and identifies our potential for other managerial positions.

- The following comments are provided to assist appraisers when they use the form, and are to be read in conjunction with the instructions on the form:

Performance against objectives: It is important to comment on whether the objectives were achieved, the degree of challenge in the objectives when they were agreed and the circumstances during the year which influenced the achievement of the objectives. These circumstances are usually so significant that the subordinate’s performance cannot be rated solely on the basis of whether the objectives were achieved.

If you have required the subordinate to accept additional objectives during the year, then comment on the priorities placed on these objectives and the time required to achieve them.

Overall Performance: A rating of performance against all EAs, particularly performance against objectives. If you think this rating doesn’t adequately cover your subordinate’s performance, then you should comment and explain.

Assessment of Skills: Under each rating constructive comments are required on the subordinate’s strengths and areas for improvement.

Personal Profile: Comments should be candid and constructive.

Further comments on appraisal

- At the end of the year managers appraise the performance of each of their subordinate managers.

- As with progress reviews, the main purpose of appraisals is to improve the performance of your subordinate managers.

- Again, it is your subordinates’ performance that is appraised, not their personality.

- Appraisals must be face-to-face because, as with progress reviews, this is the most effective way to improve your subordinates’ performance. In addition, appraisals directly affect manager’s bonuses and future career progress.

- Appraisals are mainly based on performance against objectives. They take into account whether the objectives were achieved, the degree of challenge in the objectives when they were agreed and the circumstances during the year which influenced the achievement of the objectives. These circumstances are usually so significant that a manager’s performance cannot be rated solely on the basis of whether the objectives were achieved. When managers have been required to accept additional objectives during the year and their workload has consequently increased, appraisals take into account the priorities placed on these objectives and the time required to achieve them.

- Secondly, appraisals take into account managers’ overall performance against all their EAs.

- Appraisals should contain no surprises. All aspects of your subordinate managers’ performance should have been discussed previously at one or more of the three reviews of progress.

- One section of the managers’ appraisal form asks you to assess your subordinate managers’ various work skills and requests development plans for any areas that need improvement. It is suggested that you complete this section of the form at a progress review, and confirm it during appraisal, so as to spread your workload.

- Appraising your subordinate managers’ performance face-to-face at the end of the year is absolutely mandatory for every manager.

Performance counselling

- Performance counselling is an important part of the process involved in quarterly progress reviews and annual appraisals.

- Counselling allows subordinates to find out exactly how they are currently performing in the eyes of the manager who will appraise them at the end of the year. Unless counselled effectively, highly effective subordinates can believe that their manager is dissatisfied with their performance, while ineffective workers can believe they are performing at highly satisfactory levels.

- The main objective of performance counselling is to improve the performance of your subordinates. However, achieving a lasting change in your subordinates’ behaviour is often difficult.

- Performance counselling is a specialized skill. Few managers in any organization can be described as excellent performance counsellors and they normally undertake extensive training and regular practice. Many managers in

- Westpac consider themselves to be and are in fact excellent interviewers but this does not make them good counsellors.

- In all, there are four objectives of performance counselling:

- To help your subordinates do their job better by encouraging them to excel;

- To give your subordinates a clear picture of how well they are doing at present by showing sincere appreciation;

- To build a stronger, closer relationship with your subordinates by listening, accepting feedback and eliminating misunderstandings;

- To develop practical plans for improvement and to launch projects designed to use your subordinates’ total capabilities more completely.

- When you develop a plan to improve a subordinate’s performance, you should follow three steps:

- Identify the factors affecting your subordinate’s behaviour.

- Determine the possibility and probability of change.

- Influence by convincing your subordinate of the need for change.

- Current behaviour science research suggests a positive approach works best for improving performance. The use of punishment and fear can temporarily change the behaviour of some subordinates but rarely results in a positive attitude towards work and can result in undesirable side-effects such as increased absenteeism.

- Behaviour change brought about through positive reinforcement and feedback, such as praising sound performance and suggesting ways to improve poor performance, is more likely to be lasting and self-perpetuating than that brought about through fear.

- The basis of this positive approach is to encourage your subordinates to improve their performance. It works with everybody, from the best performer to the weakest.

- Further, it is accepted by researchers that managers of superior performing teams rate highly in the skills of maintaining personal communication with the individuals in their teams. Because each subordinate is different and has individual attitudes, the best method for communicating with and influencing each subordinate will vary.

Budgets

A major change in the bank’s accounting system was made in its move from input accounting to output accounting. This proved to be one of the most difficult exercises to undertake and some specialized outside assistance was used.

Job specification

The bank no longer has a job specification independent of the JED. For them, the JED is the job specification.

Selection

While the JED is used as an important selection tool, it is not used very often. The reason is that the bank hired relatively few managers from outside. Over 95 per cent of the top 3000+ managers joined the bank as ‘cadets’ at the age of fifteen. There is a JED for this position, of course.

Job evaluation

About half-way through their programme of change to becoming more output-oriented, the bank used the Hay Job Evaluation System for the top 100 or so managerial jobs. (They would have used the Reddin Output Method but that method was not then designed.) Naturally, the bank insisted that the Hay consultants thoroughly learned about outputs and that many of their type of job descriptions were modified to match the JEDs.

- Managers covered by Hay System complete Job Dimension Reviews, which expand on the descriptions of the output requirements of their jobs in their EAs. The information contained in Job Dimension Reviews is scored using the Hay evaluation method. The scores are based on evaluations of the know-how and problem-solving requirements of the jobs and their level of accountability, and reflect the size and relative importance of the jobs to Westpac. The scores are used to determine market-related salary ranges for the jobs and managers are placed within the salary ranges on the basis of ratings of their overall performance.

Organization design

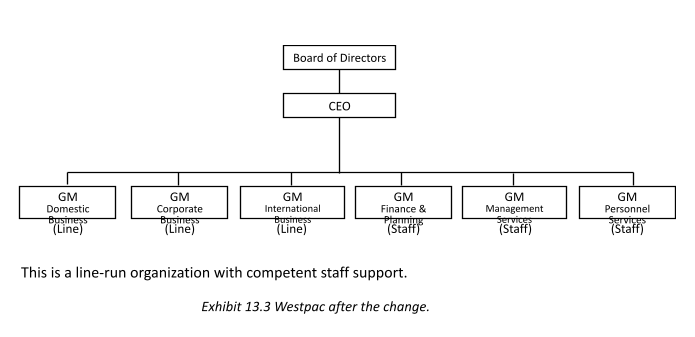

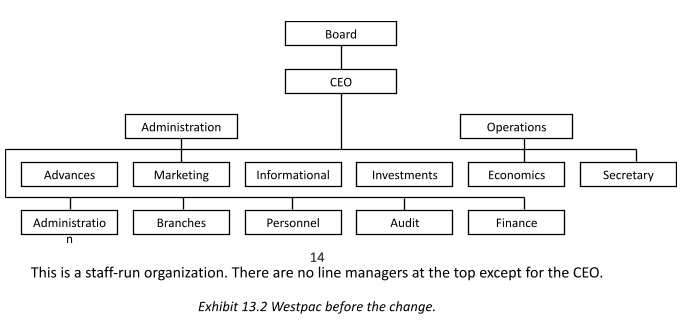

Very early in the programme of changing from inputs to outputs orientation, the bank went through a major reorganization structuring. The previous structure is shown in Exhibit 13.2.

This structure shows a high degree of staff control and virtually no one having any authority. It is also very input-oriented. In a period of only three days the bank moved then to an output-oriented structure as shown in Exhibit 13.3.

Over the next few years the bank made changes in this top level of management almost every year.

The resulting restructure achieved many objectives including:

- Moving more power from staff to line positions.

- Removing a layer of top management which permitted line general managers to report direct to the CEO.

- Reducing the numbers in the top team.

- Moving more responsibility downward to as close to the action as possible.

- Becoming more customer-oriented.

- Greater concentration on strategy and planning.

Teamwork

The bank placed a great deal of emphasis on genuine teamwork based on shared outputs.

- Westpac is structured as many interlocking teams. All managers are members of their superior’s team and, if they have subordinates, are top man or top woman of their own team.

- Teams are an effective and natural way of:

communication

gaining commitment

achieving results - One benefit of teamwork is that it improves the performance of all the team members. Teamwork must not be neglected if we are to make the best use of our people resources.

- The basis of teamwork is simple –it is talking with people. Managers are expected to talk with other managers, their subordinates and customers. If we all talk with each other more often, then better communication, understanding and cooperation will follow.

- In Westpac, much of our communication should take place and many of our management decisions should be made in team meetings. Managers are expected to actively contribute to their teams.

- Managers with subordinates are expected to know each of their team members’ competency levels and aspirations and to assist them to be more effective. This involves performance counselling of your subordinates.

- Managers are also expected to ensure that their team members are trained to use the Westpac Management System appropriately.

- All teams are expected to meet regularly. The appropriate interval will vary for different teams but should not be less than once every two months.

- Team meetings can be used for:

reviewing updating JEDs (and Job Dimension Reviews, if appropriate)

discussing and agreeing objectives and action plans

reviewing progress

exchanging information

training

Each meeting should normally be used for several or all of these purposes. - It is important to communicate to team members all decisions that will affect them. Otherwise, their commitment to the decisions will be reduced.

- As stated, the use of team meetings to ensure that members’ EAs are complementary, without overlap or underlap, is also important.

- Team meetings should always have objectives and agendas and the effectiveness of meetings should be regularly reviewed.

- There are techniques for developing teams and for improving their effectiveness in meeting their objectives. Two important processes are the Team Effectiveness Review and the Team Role Laboratory.

Rewards

The current reward system is described this way.

- Westpac’s reward system for managers consists of salaries, annual bonuses and other benefits. Our system rewards managers mainly on the basis of ratings of their overall performance against all their EAs, particularly their performance against their objectives.

- Managers’ salaries are either prescribed in industrial agreements or, starting this year, based on the Hay system of job evaluation and salary administration.

- Whether individual managers move over time to more highly paid senior positions, with more demanding EAs, will increasingly depend on their track record of objective achievement and performance against EAs. Also taken into account are managers’ location preferences; and any strengths or weaknesses in their skills, as all positions have specific skill requirements.

- Annual bonuses are distributed to some managers who achieve superior ratings of overall performance, compared with other members of their team or peer group.

- Other benefits are related to responsibility and performance.

- Thus, our rewards are the final link in a chain that starts with our JEDs and the objectives we set.

- Future changes in our reward system will be designed to ensure that the highest rewards go to the highest achievers. This will support our driving force goal of encouraging excellent performance by managers.

Taken from: “The Output Oriented Manager”, by W. J. Reddin, Part IV – Case Studies, Chapter 13,

Published by Gower Publishing Company Limited, England, 1989; pp. 252-270.